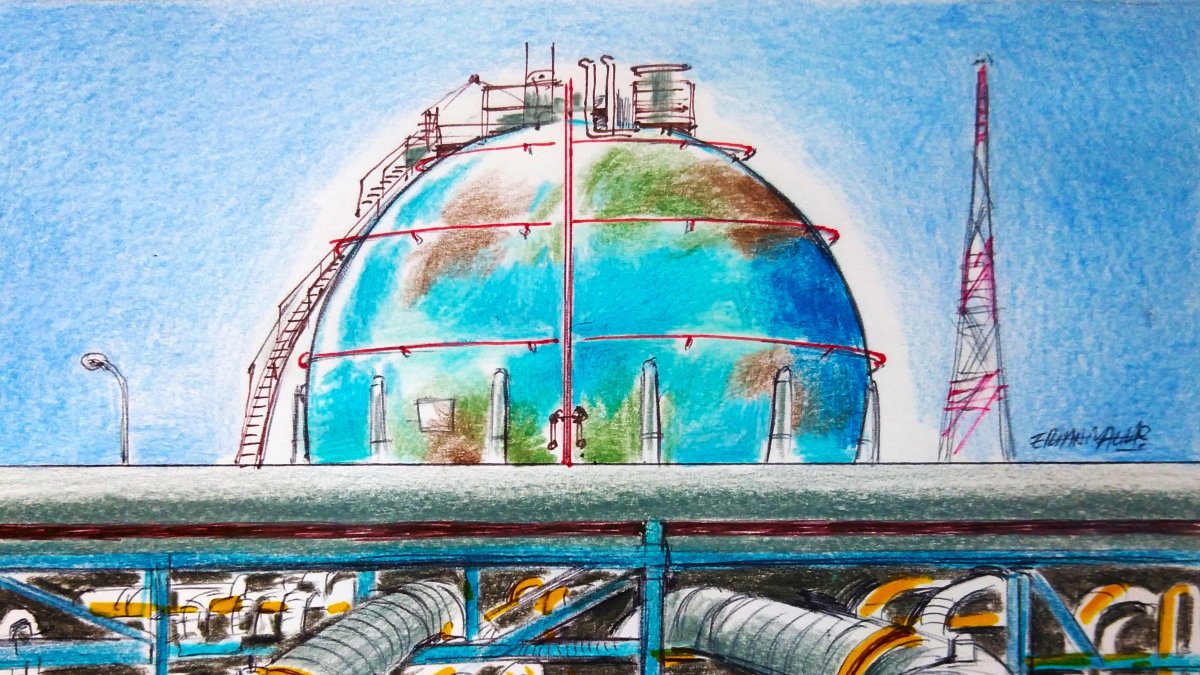

Gastech 2025: Turning point in Europe’s LNG future

Source: DAILYSABAH

With unprecedented participation from energy giants and government leaders, Gastech 2025, held in Italy, served as a key catalyst for investments and partnerships that will strengthen natural gas supply and ensure stable, affordable energy access for billions of people worldwide. The event’s dedicated networking platforms paved the way for more than 20 agreements and memoranda of understanding, resulting in deals worth over $60 billion for the global energy sector. Gastech 2025 consolidated its position as the world’s largest and most influential exhibition and conference, driving growth and transformation in natural gas, LNG, hydrogen, climate technologies and artificial intelligence applications in the energy sector.

The event hosted prominent figures, including Türkiye’s Minister of Energy and Natural Resources, Alparslan Bayraktar; the European Commission’s Director-General for Energy, Ditte Juul Jorgensen; U.S. Secretary of the Interior, Doug Burgum; and U.S. Secretary of Energy, Chris Wright. The participation of more than 400 senior speakers and 25 international ministers from key energy markets, such as Egypt, Greece, Hungary, and Nigeria, underscored Gastech’s unique capacity to convene top-level decision-makers and accelerate global collaborations that are reshaping the energy landscape.

Gastech 2024 vs. 2025

When comparing Gastech 2024 and Gastech 2025, apparent shifts emerge in the dynamics of the global LNG market and deal-making. The 2024 event, held in Houston, focused largely on technology, infrastructure investment and sustainability alongside key discussions about the future of the energy industry. Announcements in 2024 centered on LNG carrier modernization, retrofit projects and digitalization solutions; however, large-scale, long-term LNG sales agreements remained relatively limited. This reflected heightened market uncertainty that year, with buyers adopting a more cautious stance. Agreements revealed in Houston primarily took the form of cooperation memoranda rather than binding commercial commitments based on capacity, laying the strategic groundwork for the industry.

By contrast, Gastech 2025 in Milan presented a very different picture. Taking place amid intensifying debates over Europe’s energy security, LNG supply agreements moved to the center stage of discussions. Turkish Petroleum Pipeline Corporation (BOTAŞ)’s announcement of an import commitment of approximately 15 billion cubic meters during the event was a significant development, signaling both Türkiye’s vision of an energy trading hub and its integration with Europe’s LNG infrastructure. That volume corresponds to approximately 11-12 million tonnes of annual LNG capacity, representing a substantial presence in regional markets. Italy’s Edison has signed a long-term LNG supply deal with Shell, covering approximately 0.7 million tonnes per year, reinforcing the trend among major European buyers toward flexible, diversified LNG sources. In addition, PetroChina’s multiple cooperation agreements with Equinor, BOTAŞ, Titan and GasCo highlighted the increasingly complex and multi-centered structure of LNG trade between Asia and Europe. The strategic partnership announced by Eni and Petronas further supported this trend.

While Gastech 2024 resembled a technology-oriented platform, Gastech 2025 in Milan became a stage for concrete LNG supply contracts with direct market implications. This shift reflected not only companies’ strategic reorientations but also the fragility of global supply-demand balances and Europe’s efforts to secure energy supply in the post-Russia era. The agreements signed in Milan were viewed as critical developments that are likely to shape the direction of LNG trade over the next three to five years.

Another notable feature of Gastech 2025 was that, although renewable energy and energy transition themes were integrated into the program, the exhibition’s focal point remained LNG and natural gas agreements. For Europe, the LNG deals signed at Gastech 2025 should be assessed on several levels. The European Union has long sought to position itself as a pioneer of the green transition, with programs such as Fit for 55 and REPowerEU designed to accelerate the deployment of renewable energy, sharply reduce carbon emissions, and phase out fossil fuels. Yet in Milan, the dominant agenda shifted from the rhetoric of green transition to the imperatives of energy and supply security.

Challenges Europe faces

Following the crisis with Russia, Europe was compelled to rapidly diversify its natural gas dependence. In this process, LNG has evolved beyond being a mere transition fuel to become a security anchor that stabilizes the system. Edison’s long-term 0.7 million tonnes per year supply deal with Shell serves as a symbolic example. Similarly, BOTAŞ’s approximately 15 bcm import commitment carries strategic importance not only for Türkiye but also for gas transit to the EU and for Türkiye’s vision of an energy trading hub. The stance displayed by European companies and governments in Milan reflects the perceived need to secure the renewable transition with LNG in the short term.

This situation exposes Europe’s “double discourse.” On the one hand, net-zero targets and Green Deal debates continue in Brussels; on the other, under pressure from energy crises, companies are signing 15-to 20-year LNG contracts. This indicates that, in practice, Europe will continue to rely on fossil infrastructure in the short and medium term, attempting to legitimize this reliance by framing LNG as a “bridge fuel.” The relative sidelining of renewable energy discussions at Gastech 2025 further underscored the gap between market realities and political ideals. For Europe, LNG agreements do not represent a backward step but rather an acknowledgment that the green transition alone cannot guarantee energy security.

Moreover, Gastech marked a clear return to long-term contracts. Several key factors explain this shift. First, market price volatility: the sharp fluctuations in spot LNG prices during 2022-2023 intensified buyers’ desire for predictable, fixed-price supply arrangements. Second, intense competition over global LNG supply, particularly China’s and India’s aggressive procurement strategies, pushed Europe toward securing long-term deals. Third, the technologies promised by the energy transition are not yet fully capable of ensuring supply security: the intermittency of wind and solar, insufficient storage solutions and the immaturity of hydrogen projects all keep LNG at the forefront.

However, the resurgence of long-term contracts also brings risks. A serious contradiction arises between Europe’s net-zero targets and entering binding LNG commitments that extend beyond 2040. If renewable investments expand rapidly, these contracts could create a costly lock-in effect. Yet in the hierarchy of priorities between energy security and climate goals, it is clear that, for now, security concerns prevail.

The original article: belongs to DAILYSABAH .